Contents

—Like all technical indicators, it is important to use the Williams %R in conjunction with other technical analysis tools. —Can be used to generate trade signals when the price and the indicator move out of overbought or oversold territory. —The indicator focuses on the last 14 periods but is scaled to zero and -100. %R reading above -50 means the price is moving upward. The Williams %R is available on most trading platforms, such as Tradingview and MetaTrader. The indicator is also available on many free online charting sites, such as Investing.com, StockCharts.com and Yahoo! Finance.

With solid research and in-depth analysis Equitymaster is dedicated towards making its readers- smarter, more confident and richer every day. Here’s why hundreds of thousands of readers spread across more than 70 countries Trust Equitymaster. Larry has been a two time elected republican party politician.

Understanding Futures and Options

It is plotted against the -50 range in the middle line, which helps differentiate the strength of a trend. —Williams %R is a momentum oscillator that measures the level of the close relative to the high-low range over a given period of time. —The Williams %R represents a market’s closing level versus the highest high for the lookback period. Conversely, the Fast Stochastic Oscillator, which moves between 0 and 100, illustrates a market’s close in relation to the lowest low.

They will guarantee not a solitary individual trader ought to need to experience the ill effects of an exchanging system guide that confounds them. In this episode, Matt Zimberg from Optimus Futures joins me to discuss decision making, what traders do wrong and how to be a more successful trader by making better trading decisions. If you’re looking for inspiration, motivation and practical advice on improving your trading results, Better System Trader delivers every week. Each episode brings you an expert trader who shares their own story, along with the steps, both good and bad, that they’ve taken on their path to success.

But in a trending market a Williams %R indicator is seen not to fare too well, eventually, leading to losses for traders and investors. It is a momentum indicator similar to the stochastic oscillator. It helps traders and investors determine when to buy or sell a stock by providing them with triggers.

“KYC is one time exercise while dealing in securities markets – once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.” While this indicator focuses only on the last 14 periods, it is scaled between zero and -100. If it shows a reading above -50, the price is said to be moving upwards. If it shows a reading close to -100, it means that stock price has reached oversold levels. As a trader hoping to implement the Williams percent range strategy, you must understand the formula and its construction.

Here’s how one can use Williams %R technical indicator for buying & selling

I can teach someone having nominal money to make a lot of money, even in a single day. At the same time, the practice is also extremely risky. Minimize your risk and maximize your opportunities for success with Larry Williams’s Long-Term Secrets to Short-Term Trading, Second Edition. A simple and classic strategy on market, created by LarryWillians using a EMA9. The brute model use a Cross from closing price on EMA9. In other to correct this kind of thing, I add a SMA21 to confirm the trend and decrease numbers of false trades.

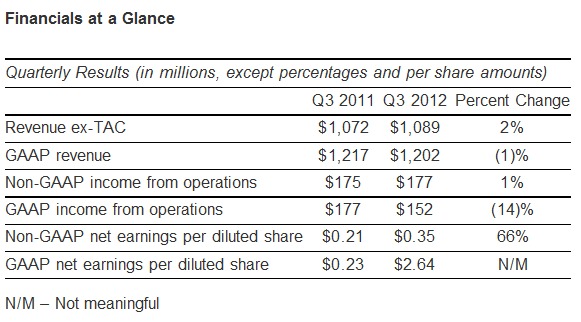

No worries for refund as the money remains in investor’s account. We ran an exercise to see which large cap stocks are in the bearish zone as per Williams %R. In particular, we looked at stocks with the William %R just crossing over -20 mark from the previous score at that level. We spotted around 55 such companies, mostly in the small and micro-cap space, which could be set for a trend reversal.

Technical/Fundamental Analysis Charts & Tools provided for research purpose. Please be aware of the risk’s involved in trading & seek independent advice, if necessary. Volume, chart patterns and breakouts can be used to confirm or refute signals produced by Williams %R. The centerline, -50, is an important level to watch. If one is familiar with divergence then one can use the Williams %R divergence to confirm if the price of the stock is going to continue trending in the current direction or would it likely reverse directions anytime soon. Williams %R divergences are considered very powerful.

ICT’s structure has some differences and it is explained for free in his 2022 youtube mentorship, mostly in the… This indicator is based on the Larry Willians 9.1 Strategy. It will paint the candles WHITE when Long entries are activated and BLACK when short entries are activated. There is an option to include an EMA or SMA filter.

Stocks Talk Forum

Gold prices usually decline around August every year only to rally by January the following year. “The stock market is a major stream of income and Williams clearly shows the best time and stocks to buy.” Sharing his years of experience as a seasoned and successful trader, Williams offers his market wisdom on a wide range of topics, from chaos and speculation to volatility https://1investing.in/ breakouts and profit patterns. With his expert guidance, you’ll learn about such fundamentals as how the market moves, what are the three most dominant cycles, when to exit a trade, and how to hold on to winners until the end of your chosen time frame. Larry Williams has never backed away from authority, especially government authority – the U.S. or any other.

- Then his plane landed in Australia and he was summarily arrested and jailed and taken to prison There began a nearly 4 year fight for his freedom at a huge financial cost; worse was the toll it took on his psyche.

- A trader first needs to understand himself before striking out in the market.

- Another advantage of the Williams %R indicator is that it’s extremely useful and profitable in markets that are trading sideways or non-trending.

- That is why I prefer those who have never traded.

- The battle as well as how and why I got into it is fully covered in the book.

While its primary function is to define oversold and overbought zones, it also works in conjunction with other technical indicators which help you identify bearish and bullish divergences as well as failure swings. To know more about Williams R, contact Angel One experts. Williams R can be used for generating trade signals, when both, the indicator and the price move out of the oversold or overbought territory.

What listeners say about Better System Trader

A trader first needs to understand himself before striking out in the market. If you want to trade daily and the market opens at 5.30 in the morning you better be awake well before that. A day trader ought to be watching the market through the day. Once you have figured that out, the rest is relatively easy. Filled with invaluable insight, precise rules and formulas, and helpful advice from one of today’s most respected market players, this comprehensive and practical resource will serve as the basis for, if not indeed become, your short-term trading “gospel.”

It can, also, help ascertain whether a recent trend in the price of a stock will continue or revert to its original position. You’ll be introduced to the best resource for achieving this goal–the COT–and learn exactly what this information means for you. Williams explains this reporting system in detail and lays out a plan that will is word of mouth hyphenated allow you to maximize profits and manage downside risk by trading side by side with the largest commercial interests in the world. You’ll be introduced to the COT report, the best resource for achieving trading success, learn exactly what the information it contains means, and plan for maximizing profits by acting on reported actions.

A futures contract can be “bought” or “sold” but no money exchanges hands upfront, except from depositing initial margin to lower the risk of non-payment. Indian indices have traded mixed this year, as the BSE Sensex soared 2.80 per cent, the BSE Midcap index soared 0.28 per cent and the BSE Smallcap index plunged 2.96 per cent. Pay 20% or “var + elm” whichever is higher as upfront margin of the transaction value to trade in cash market segment. Update your mobile number & email Id with your stock broker/depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge. The Williams R indicator, like most momentum indicators, appears in a separate window on a chart below the price chart.