A writer still has to pay $1500 for her computer whether she writes one article on it or 1,000. The average price of all the goods in stock, regardless of purchase date, is used to value the goods sold. Taking the average product cost over a time period has a smoothing effect that prevents COGS from being highly impacted by the extreme costs of one or more acquisitions or purchases. LIFO is where the latest goods added to the inventory are sold first. During periods of rising prices, goods with higher costs are sold first, leading to a higher COGS amount. To illustrate this, consider a business that has $500,000 in gross revenue and $200,000 in COGS.

Special Identification Method

- For example, COGS for an automaker would include the material costs for the parts that go into making the car plus the labor costs used to put the car together.

- An inflated COGS (as a result of overestimating direct costs) can create the illusion of lower gross profit margins.

- For example, if you own a smoothie food truck, the cost of your frozen fruit would count as inventory.

COGS includes the direct cost of producing a good or the wholesale price of goods resold. It also includes other potentially deductible costs such as labour, supplies, shipping costs, freight, and directly related overhead. Reliable accounting methods are especially crucial for businesses with large inventories, as they often have substantial COGS. Accurate, timely calculation and tracking of COGS help them correctly determine their taxable income, optimize their tax liabilities, and avoid unnecessary penalties. That’s why it is paramount to differentiate between direct and indirect costs appropriately and ensure that costs are correctly classified when computing COGS. Transparent and accurate categorization of costs enhances financial analysis, fostering better decision-making based on precise data.

Everything You Need To Master Financial Modeling

Cost of Goods Sold (COGS) is an account that tracks the expenses incurred in producing an item or product for sale. It is an important metric for businesses as it helps them calculate their gross profit and taxable income. COGS includes the direct costs of producing a good, such as raw materials, labour, and taxes, as well as indirect costs like administrative expenses, rent, and utilities. However, not all businesses can claim COGS deductions, as it does not apply to service-based businesses that don’t produce or carry inventory.

Operating Income: Understanding its Significance in Business Finance

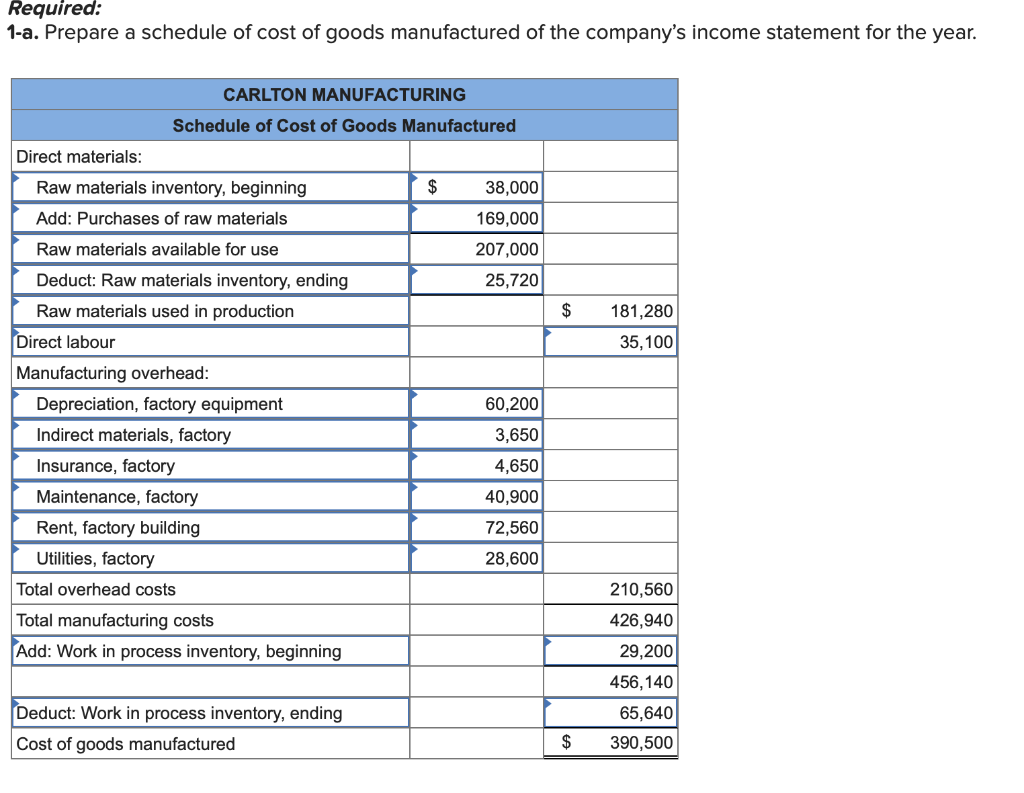

The cost of goods sold (COGS) is the cost related to the production of a product during a specific time period. It’s an essential metric for businesses because it plays a key role in determining a company’s gross profit. For each of the above accounting methods, a certain amount of accounting acumen helps when gathering the information for your income statement. FreshBooks offers COGS tracking as part of its suite of accounting features. It can help you track and categorise your expenses more accurately. Accurate records can give you peace of mind that you are on track come reporting time.

What Is the Cost of Goods Sold Formula?

If inventory decreases by 50 units, the cost of 550 units is the COGS.

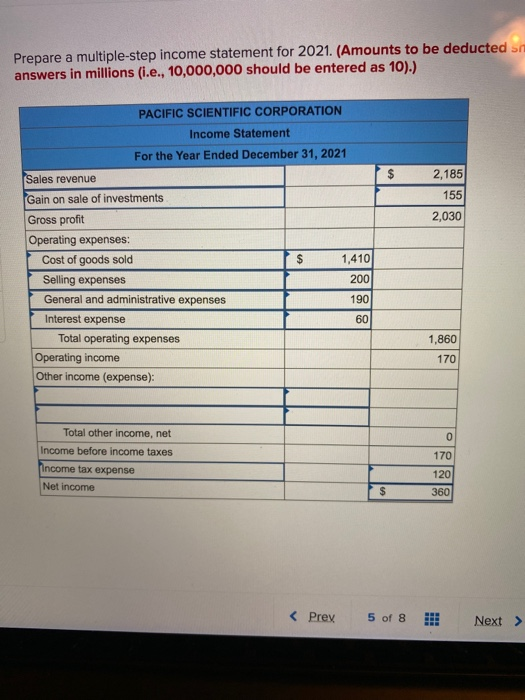

Cost of Goods Sold Calculation Example (COGS)

Direct expenses help set the cost of a product or service, while indirect expenses are evaluated to calculate operating expenses and overheads. Proper budgeting and forecasting of these expenses by financial experts are crucial for thorough financial planning and maintaining tax compliance. Firstly, an accurate accounting of COGS is invaluable in ascertaining precise profit margins.

You should record the cost of goods sold as a debit in your accounting journal. In other words, divide the total cost of goods purchased in a year by the total number of items purchased in the same year. Due to inflation, the cost to make rings increased before production ended. Using FIFO, the jeweler would list COGS as $100, regardless of the price it cost at the end of the production cycle. Once those 10 rings are sold, the cost resets as another round of production begins.

Unlike COGS, operating expenses (OPEX) are expenditures that are not directly tied to the production of goods or services. For example, airlines and hotels are primarily providers of services such as transport are salaries part of cost of good sold and lodging, respectively, yet they also sell gifts, food, beverages, and other items. These items are definitely considered goods, and these companies certainly have inventories of such goods.