Content

For example, you can find programs built to make it traders in order to pond their cash to buy commercial a house. It’s easy to start once you discover a financial investment membership having SoFi Invest. You might purchase carries, exchange-exchanged money (ETFs), shared finance, choice money, and a lot more. SoFi doesn’t charges income, however, other costs pertain (complete commission disclosure right here). Understanding the basics from money places is very important to possess people, as they begin to end up being getting together with numerous financing places in their spending journeys.

Investment Segments Method & Efforts Director

Economic analysts are experts who get acquainted with and you may interpret financial investigation and you may market fashion to incorporate expertise and you can guidance to help you investors or other stakeholders. When interest in a safety expands, the purchase price generally develops, and vice versa. Business players such agents, buyers, and you will business manufacturers helps positions anywhere between consumers and you may providers. It make it traders so you can broaden the portfolios, reducing its exposure to one solitary advantage otherwise business.

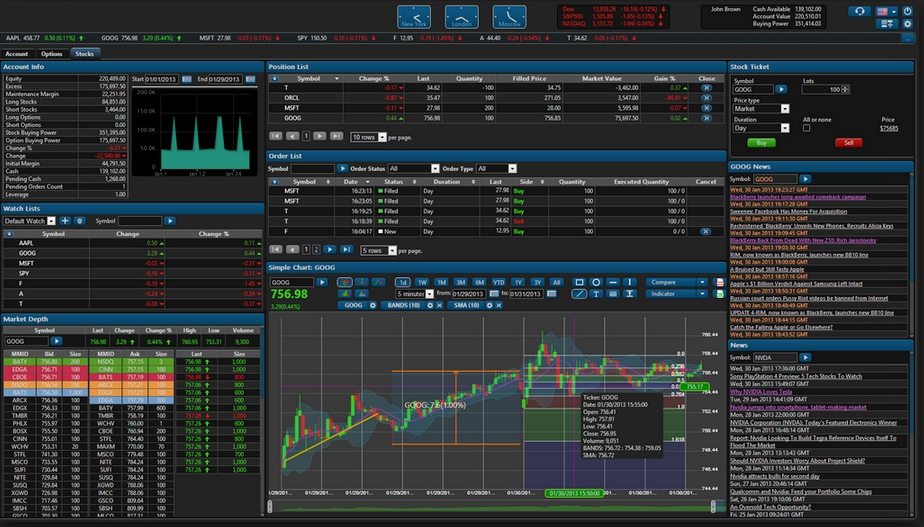

Typical Job Obligations inside Exchange

Money locations traders work with the brand new active trade floors, where their work time may be very fast-moving and you may disorderly. To possess an investor, your prosperity is quite essentially the level of profit you create for the financial (entitled P&L for profit-and-losses statement). When you are you will find reviews provided by businesses and counterparty reviews provided by customers, the value of a trader is how they could quickly get to know and you can operate for the places to maximise the P&L. What’s more, it provides a means of making sure the financial institution isn’t affected is always to a trader actually be lured from the company from the an opponent. While we seek to provide accurate and you will prompt information, there is certainly zero make certain that for example information is direct since the of your own date it’s received or that it will continue to be direct subsequently. You must not do something about such information rather than suitable expert advice once an intensive examination of the particular problem.

Currency Field against. Money Field: What is the Differences?

KPMG’s multi-disciplinary strategy and you may deep, simple industry degree let customers satisfy pressures and you will address possibilities. S&P 500 Tools List comprises the individuals companies as part of the S&P 500 that will be categorized as the people in the fresh GICS tools business. S&P five-hundred It Directory constitutes those individuals enterprises within the S&P five hundred which can be categorized as the members of the newest GICS suggestions technical business. Russell 1000 Worth List tips the new efficiency of highest-cover value segment of the You.S. collateral universe. Including, in the industrials business, organizations for example aerospace portion brand name and you will creator TransDigm features wanted so you can tap into increasing global interest in industrial traveling. Similarly, GE Aerospace, earlier an excellent conglomerate which have welfare in the news, energy and healthcare, has reorganized alone to target creating spraying engines.

When you are new to HBS Online, you happen to be expected to create a merchant account just before joining in the system of your choosing. Zero, our very own applications try 100 percent on the web, and you may offered to professionals no https://southernoilcompany.com/2024/11/24/autotrading-definition-immediate-edge-schweiz-verfahren-vor-und-nachteile/ matter their location. The platform features quick, highly produced video clips from HBS professors and you may invitees company benefits, interactive graphs and you may teaching, cooler phone calls to keep you interested, and chances to sign up to a vibrant online community. The bigger stock-exchange comprises of numerous circles you may want to invest in.

Inside the tall issues, it may cause business incapacity, including the 2007–2008 financial crisis. There are even certain thread locations you to facilitate exchange of ties, such as the NYSE Securities business. The brand new U.S. Treasury’s Treasury Direct is yet another exemplory case of a market, the spot where the bodies offers financial obligation ties for example Treasury ties in person to your social. If you buy the safety on the additional field, you’re nevertheless due payments granted from the team. Meaning principal and you will attention costs on the bonds and you will dividend repayments on the brings tends to make its way to your account. To get into public money as a result of a bond matter, a friends or another entity can start from the sharing their you want for investment with a financial investment lender.

Listed below are multiple means communities can be best create asymmetric suggestions and you will the principal-broker condition within funding locations. Raising financing due to collateral areas also offers many perks for enterprises. Dependent inside 1993, The new Motley Fool is actually a financial features company dedicated to to make the world smarter, pleased, and you may richer. The newest Motley Deceive are at lots of people monthly as a result of our advanced spending options, 100 percent free advice and you can business analysis to the Deceive.com, top-rated podcasts, and you will non-profit The fresh Motley Fool Foundation.

RBC Charity Time for the children Donates Millions in order to Youth

Financing financial institutions act as underwriters in the process of giving securities. They pick securities in the giving team at the a low price after which sell these to buyers to have a top speed. It permit organizations to access the main city they have to develop the surgery and spend money on the new innovation. So it brings operate and generates monetary activity, contributing to total monetary progress. It support the procedure of financing creation, that’s important to financial development.

Not only will it be provided with high change limits, they might attract more portion to trade or maybe more direct records. That it at some point contributes to the chance of greatest performance, and that connections to the even higher shell out. While we have a tendency to discover opportunities inside the transformation and trading (S&T) lumped along with her, the brand new operate of conversion and you may change have become type of, requiring some other feel and you can obligations. The number of ties one to first started exchange for the The fresh York Stock exchange may 17, 1792—its first-day out of exchange.

It is an excellent harmony between research and you may abdomen that allows an informed people and then make split-second choices on the price of a secured asset or when you should pick, offer, or keep. Financing market describes a broad spectral range of tradeable property you to definitely comes with the market as well as other locations for exchange other financial products. Now, since the 3Q24 involves a virtually, let us search right back from the just what which diverse lineup from advantages needed to say, not just regarding it year, exactly what lies ahead.

The city-state’s monetary segments perform below effective and you may clear laws you to definitely fall into line that have around the world conditions. The newest secondary field, concurrently, has spots supervised from the a regulatory looks for instance the Bonds and you may Change Commission (SEC) in which established or already-provided securities is actually exchanged ranging from people. The newest York Stock exchange (NYSE) and you can Nasdaq are examples of the fresh secondary field. Such, a company requires money to possess company operations and generally borrows it from households otherwise anyone.